The assumption is that all income from the company in one year is held for future use. One such expense that’s determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors. Permanent accounts track activities that extend beyond the current accounting period. They’re housed on the balance sheet, a section of financial statements that gives investors an indication of a company’s value including its assets and liabilities. Once all of the temporary accounts have been closed, review the journal entries to ensure that they are accurate and complete.

What are the transactions made at the end of an accounting period?

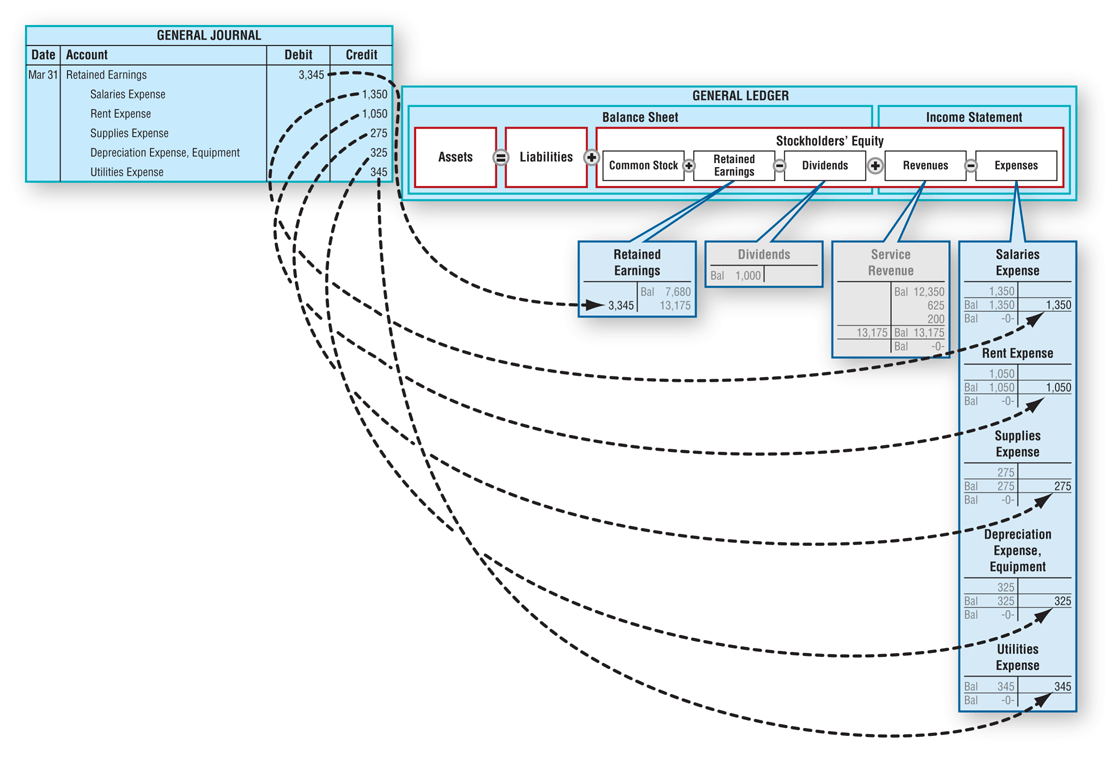

The balance in Income Summary is the same figure as whatis reported on Printing Plus’s Income Statement. To further clarify this concept, balances are closed to assureall revenues and expenses are recorded in the proper are two incomes better than one for married taxpayers period andthen start over the following period. The next step is to repeat the same process for your business’s expenses. All expenses can be closed out by crediting the expense accounts and debiting the income summary.

Close all revenue and gain accounts

- This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary.

- The statement of retained earnings shows the period-endingretained earnings after the closing entries have been posted.

- The balance in Income Summary is the same figure as whatis reported on Printing Plus’s Income Statement.

- For those trying to extract insights from company financials, then flux will generally sit as a post-close activity.

- And so, the amounts in one accounting period should be closed so that they won’t get mixed with those in the next period.

The account is then cleared out and transferred to retained earnings, which we will explain. Closing entries in accounting are something you are certainly going to run across if you take a position in internal accounting. While they tend to be similar and repetitive, it is worth having a good understanding of what entries are being made and why they are being made.

Closing Entry – FAQs

However, your business is also free to handle closing entries monthly, quarterly, or every six months. In essence, we are updating the capital balance and resetting all temporary account balances. Income and expenses are closed to a temporary clearing account, usually Income Summary. Afterwards, withdrawal or dividend accounts are also closed to the capital account. This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary.

How Highradius Can Help You Streamline Your Accounting Management

It lists the current balances in all your general ledger accounts. In this case, we can see the snapshot of the opening trial balance below. Keep in mind, however, that this account is only purposeful for closing the books, and thus, it is not recorded into any accounting reports and has a zero balance at the end of the closing process.

Closing entries help in the reconciliation of accounts which facilitates in controlling the overall financials of a firm. All accounts can be classified as either permanent (real) ortemporary (nominal) (Figure5.3). It’s vital in business to keep a detailed record of your accounts. Answer the following questions on closing entries and rate your confidence to check your answer. Net income is the portion of gross income that’s left over after all expenses have been met.

Creating closing entries is one of the last steps of the accounting cycle. Also known as real or balance sheet accounts, these are general ledger entries that do not close at the end of an accounting period but are instead carried forward to subsequent periods . Real accounts, also known as permanent accounts, are quite different compared to their temporary equivalents.

Use one of our industry-specific checklist templates — retail, SaaS, manufacturing, real estate, and more. Notice that the Income Summary account is now zero and is readyfor use in the next period. The Retained Earnings account balanceis currently a credit of $4,665. The third entry requires Income Summary to close to the RetainedEarnings account. To get a zero balance in the Income Summaryaccount, there are guidelines to consider.